What Is Overlapping Candlesticks . however, i frequently observe the oposite in that there are overlaps of candles, ie. the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. Sure, it is doable, but it requires special training. trading with overlapping candles could be profitable. The closing value of one timeframe is lower that the opening value of the. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. the bottom shadows of the candles are the overlap area. Trading without candlestick patterns is a lot like flying in the night with no visibility. You can trade it at different time frames if it fits best for you. It is a variant of the upside tasuki gap.

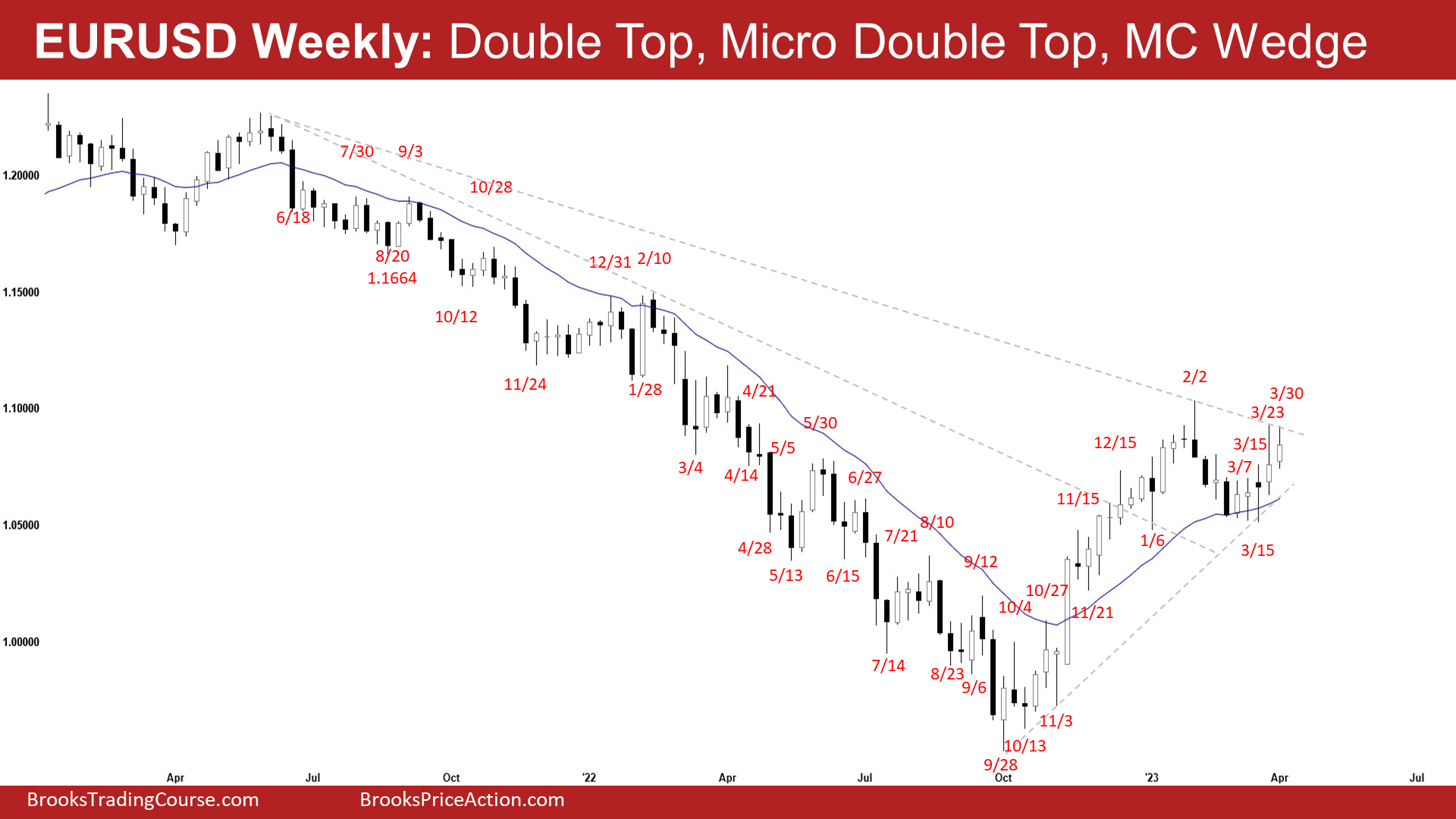

from www.brookstradingcourse.com

the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. trading with overlapping candles could be profitable. You can trade it at different time frames if it fits best for you. It is a variant of the upside tasuki gap. Sure, it is doable, but it requires special training. however, i frequently observe the oposite in that there are overlaps of candles, ie. Trading without candlestick patterns is a lot like flying in the night with no visibility. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. The closing value of one timeframe is lower that the opening value of the. the bottom shadows of the candles are the overlap area.

EURUSD Overlapping Candlesticks Brooks Trading Course

What Is Overlapping Candlesticks however, i frequently observe the oposite in that there are overlaps of candles, ie. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. however, i frequently observe the oposite in that there are overlaps of candles, ie. Trading without candlestick patterns is a lot like flying in the night with no visibility. It is a variant of the upside tasuki gap. the bottom shadows of the candles are the overlap area. trading with overlapping candles could be profitable. The closing value of one timeframe is lower that the opening value of the. Sure, it is doable, but it requires special training. the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. You can trade it at different time frames if it fits best for you.

From mavink.com

Candlestick Patterns Guide What Is Overlapping Candlesticks the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. trading with overlapping candles could be profitable. however, i frequently observe the oposite in that there are overlaps of candles, ie. The closing value of one timeframe is lower that the opening value of the.. What Is Overlapping Candlesticks.

From centerpointsecurities.com

Bullish Candlestick Patterns 8 Patterns to Know What Is Overlapping Candlesticks the bottom shadows of the candles are the overlap area. trading with overlapping candles could be profitable. It is a variant of the upside tasuki gap. however, i frequently observe the oposite in that there are overlaps of candles, ie. Sure, it is doable, but it requires special training. candlesticks patterns are used by traders to. What Is Overlapping Candlesticks.

From www.brookstradingcourse.com

EURUSD Overlapping Candlesticks Brooks Trading Course What Is Overlapping Candlesticks The closing value of one timeframe is lower that the opening value of the. the bottom shadows of the candles are the overlap area. Trading without candlestick patterns is a lot like flying in the night with no visibility. It is a variant of the upside tasuki gap. candlesticks patterns are used by traders to gauge the psychology. What Is Overlapping Candlesticks.

From www.pinterest.com

All types of candle stick you should know. If you want to trade Forex What Is Overlapping Candlesticks It is a variant of the upside tasuki gap. You can trade it at different time frames if it fits best for you. however, i frequently observe the oposite in that there are overlaps of candles, ie. the bottom shadows of the candles are the overlap area. trading with overlapping candles could be profitable. The closing value. What Is Overlapping Candlesticks.

From www.studytienganh.vn

"Overlap" nghĩa là gì Định Nghĩa, Ví Dụ trong Tiếng Anh What Is Overlapping Candlesticks the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. Trading without candlestick patterns is a lot like flying in the night with no visibility. however, i frequently observe the oposite in that there are overlaps of candles, ie. You can trade it at different time. What Is Overlapping Candlesticks.

From www.brookstradingcourse.com

Crude Oil Overlapping Candlesticks Brooks Trading Course What Is Overlapping Candlesticks candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Sure, it is doable, but it requires special training. the bottom shadows of the candles are the overlap area. It is a variant of the upside tasuki gap. trading with overlapping. What Is Overlapping Candlesticks.

From www.investopedia.com

Understanding a Candlestick Chart What Is Overlapping Candlesticks the bottom shadows of the candles are the overlap area. Trading without candlestick patterns is a lot like flying in the night with no visibility. Sure, it is doable, but it requires special training. It is a variant of the upside tasuki gap. however, i frequently observe the oposite in that there are overlaps of candles, ie. You. What Is Overlapping Candlesticks.

From www.brookstradingcourse.com

EURUSD Overlapping Candlesticks Brooks Trading Course What Is Overlapping Candlesticks the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. The closing value of one timeframe is lower that the opening value of the. It is a variant of the upside tasuki gap. however, i frequently observe the oposite in that there are overlaps of candles,. What Is Overlapping Candlesticks.

From www.tradingfuel.com

10 Price Action Candlestick Patterns Trading Fuel Research Lab What Is Overlapping Candlesticks candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Sure, it is doable, but it requires special training. Trading without candlestick patterns is a lot like flying in the night with no visibility. however, i frequently observe the oposite in that. What Is Overlapping Candlesticks.

From www.technicaltrader615.com

Overlapping Candles What Is Overlapping Candlesticks Sure, it is doable, but it requires special training. You can trade it at different time frames if it fits best for you. trading with overlapping candles could be profitable. Trading without candlestick patterns is a lot like flying in the night with no visibility. however, i frequently observe the oposite in that there are overlaps of candles,. What Is Overlapping Candlesticks.

From trendspider.com

Candlestick Patterns An Essential Guide TrendSpider Learning Center What Is Overlapping Candlesticks The closing value of one timeframe is lower that the opening value of the. Trading without candlestick patterns is a lot like flying in the night with no visibility. trading with overlapping candles could be profitable. You can trade it at different time frames if it fits best for you. candlesticks patterns are used by traders to gauge. What Is Overlapping Candlesticks.

From www.publish0x.com

How to Read Candlesticks For Trading What Is Overlapping Candlesticks Trading without candlestick patterns is a lot like flying in the night with no visibility. Sure, it is doable, but it requires special training. It is a variant of the upside tasuki gap. trading with overlapping candles could be profitable. You can trade it at different time frames if it fits best for you. however, i frequently observe. What Is Overlapping Candlesticks.

From www.tradingsim.com

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim What Is Overlapping Candlesticks however, i frequently observe the oposite in that there are overlaps of candles, ie. The closing value of one timeframe is lower that the opening value of the. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. You can trade it. What Is Overlapping Candlesticks.

From www.wibestbroker.com

What are candlesticks, and how can you benefit from them? What Is Overlapping Candlesticks the second candle has a body showing the opposite, so a higher close than open, with that second candle body completely overlapping,. however, i frequently observe the oposite in that there are overlaps of candles, ie. Trading without candlestick patterns is a lot like flying in the night with no visibility. trading with overlapping candles could be. What Is Overlapping Candlesticks.

From medium.com

Master Candlestick Patterns in Just Minutes! (Part1) by Prince What Is Overlapping Candlesticks candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Trading without candlestick patterns is a lot like flying in the night with no visibility. The closing value of one timeframe is lower that the opening value of the. the second candle. What Is Overlapping Candlesticks.

From money.stackexchange.com

foreign exchange Why have candlestick charts overlaps? Personal What Is Overlapping Candlesticks You can trade it at different time frames if it fits best for you. Sure, it is doable, but it requires special training. the bottom shadows of the candles are the overlap area. Trading without candlestick patterns is a lot like flying in the night with no visibility. It is a variant of the upside tasuki gap. candlesticks. What Is Overlapping Candlesticks.

From crypto.com

How to Read Candlesticks on a Crypto Chart A Beginner’s Guide What Is Overlapping Candlesticks trading with overlapping candles could be profitable. The closing value of one timeframe is lower that the opening value of the. You can trade it at different time frames if it fits best for you. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall. What Is Overlapping Candlesticks.

From www.youtube.com

How to Read Candlesticks Chart? Basics of Technical Analysis in What Is Overlapping Candlesticks Sure, it is doable, but it requires special training. candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. The closing value of one timeframe is lower that the opening value of the. Trading without candlestick patterns is a lot like flying in. What Is Overlapping Candlesticks.